Vertigo3d/E+ via Getty Photographs

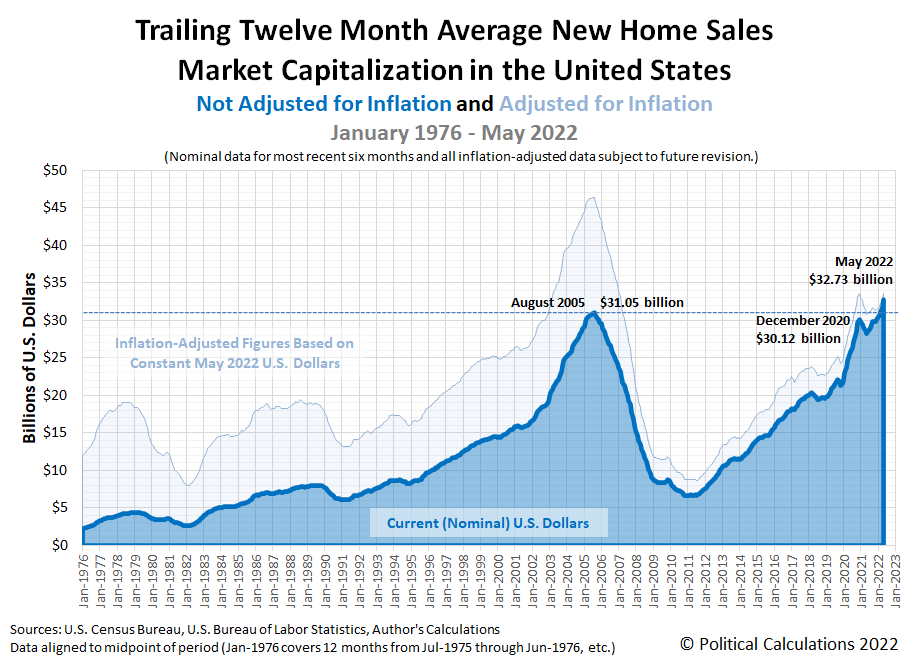

May perhaps 2022’s new home gross sales in the United States were being more powerful than expected. Political Calculations’ first estimate of the marketplace cap for new homes offered in the U.S. for the duration of Could 2022 is $32.73 billion, an raise of 3.1% from April 2022‘s revised estimate of $31.75 billion.

The most current update of our chart shows the surging market capitalization of new homes in the U.S.

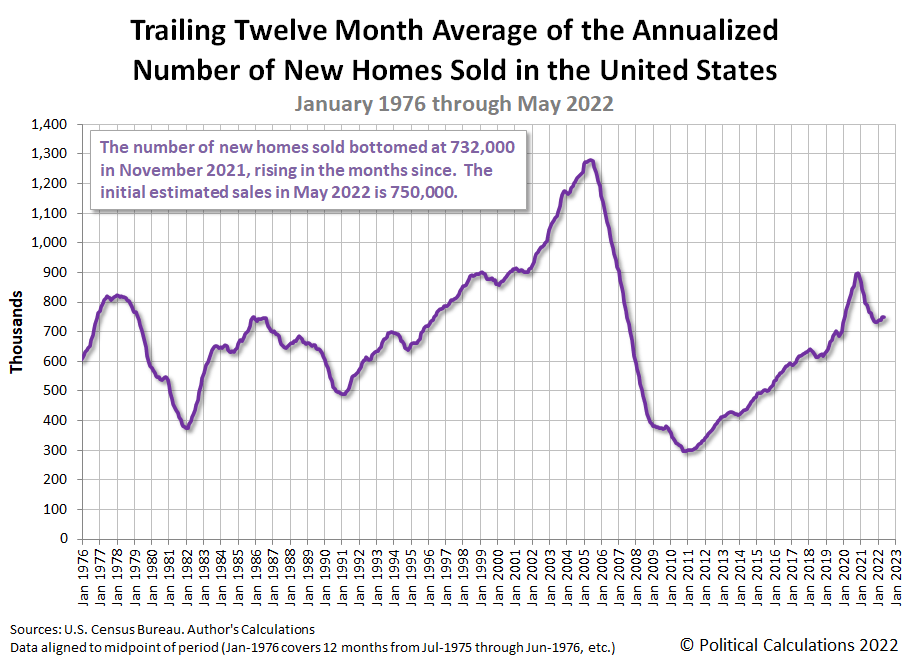

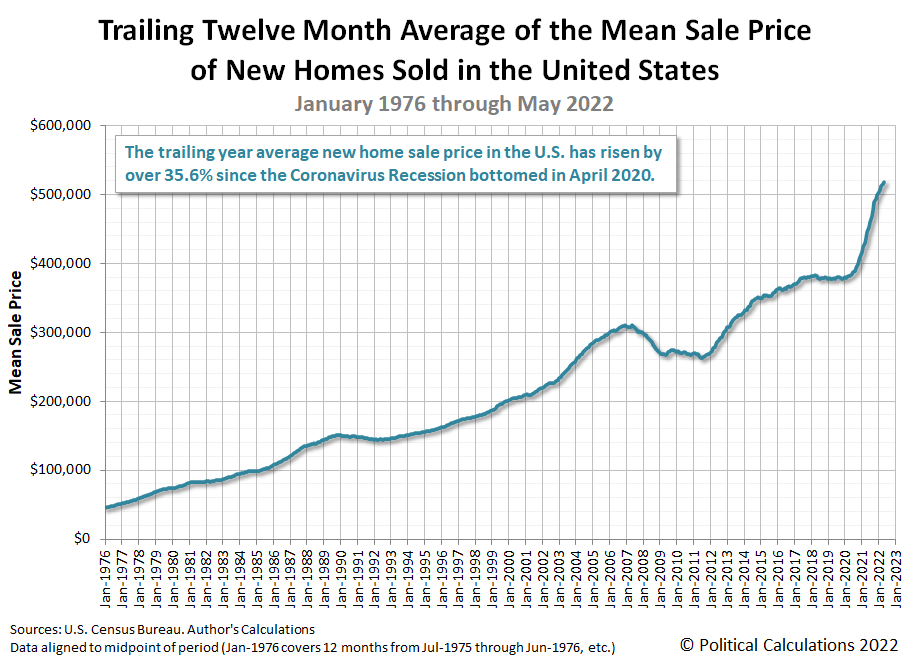

Even though soaring new property sale selling prices ongoing to improve the new residence market place cap, Could 2022’s details also benefited from an unforeseen improve in the amount of product sales that came even with surging mortgage loan charges. Both these aspects are illustrated in the following two charts.

New property gross sales rose in May well 2022:

Ordinary sale prices arrived at $518,033:

Simply because new home profits are counted towards GDP when their income contracts are signed, a soaring development in the marketplace cap for new homes boosts the U.S. economic climate. The Countrywide Affiliation of Home Builders estimates new residence profits add 3% to 5% of the nation’s Gross Domestic Item.

That may well not sound like substantially, but new dwelling product sales are providing a tailwind for an economic climate slowing under the increasing pounds of President Biden’s inflation. How prolonged that could possibly keep on in the financial local climate the Biden administration has fostered is an open issue.

Editor’s Notice: The summary bullets for this article were being preferred by Trying to get Alpha editors.