jimfeng/E+ through Getty Images

The housing market proceeds to show toughness in conditions of pricing, but largely because of to difficulties in volume. What’s likely on? Shortages all all over, born mostly of issues in logistics, with ports overwhelmed, flatbeds insufficient and container rates owning doubled because they’ve turn into so hard to come by. Materials are small, and housing inventory has slowed down significantly in conditions of turnover because there are so quite a few unfinished units. With the truth that Millennials are lastly forming people and there is fundamental inhabitants expansion, not to mention additional sq.-footage needed for function-from-dwelling applications, the slowing inventory has exacerbated an now forming housing shortage and growing price ranges. What shares stand to benefit from this recent problem of bottlenecking at the conclude of the developing cycle? We assume there is sustainable demand from customers for PVC and finishings, and that there is pent-up desire for lumber and OSB on the future start off of the creating cycle. What’s more, you can never go improper with commodities used in paint and coatings.

Though mounting charges are a legit issue for buyers, the significant enhancement from our previous perspective that predicted sizeable charge increases is the return of the expertise economic climate, which could choose the strain off the effective frontier by saying share from the goods trade. Price hikes might not have to be the only instrument to lower merchandise desire, and we are extra probably at this level to prevent a deleveraging.

Products vs. Expert services

Solutions are truly a substantially larger proportion of GDP than merchandise. Globally, expert services are about 60% of GDP, and tourism by yourself is 10%. Products and services normally fell really a good deal, with tourism likely staying the worst, slipping by 50%. With out-of-dwelling commerce currently being a large proportion of companies, which we knew fell at the very least 30% through the pandemic, you can visualize the substantial hit that services took, with dollars printing permitting goods desire to consider their put. Merchandise demand elevated by perhaps 18% as a consequence of the pandemic.

Ability will increase are coming to the tune of 20-30% in some conditions, and this need to have been sufficient to deal with inflation. The issue is that shortages are slowing down potential improves, and logistic shortages are some of the most acute shortages of all. So this is not fixing the difficulty soon more than enough. In the meantime, expectation consequences leaking into the wage-value system, as nicely as speculation, specially worsened by Russia invading Ukraine and their offer of vitality staying hoarded and a lot less than trustworthy, are building a enormous economic challenge that could demand quite significant price will increase to quiet down. The critical matter the Fed is striving to do is not cause a deleveraging as a consequence.

Our perspective was that premiums would have to enhance to 6% in purchase to smother disposable income ample to acquire the load off of the goods trade and tackle inflation. A 6% amount would be a mess for the housing market, even however a housing scarcity is making secular demand. But our newer perspective incorporates a extremely promising return of the knowledge economic system, and the restoration in mobility which ought to with each other restore solutions. We are seeing great recovery in a large amount of the barometers that observe mobility. Even professional aviation suppliers, wherever money outlays are fairly risky by buyers, are observing an uptick. Airports are entire, and that is a sign that the experience economic climate is coming back. Even if it only partly recovers, that should really reduce the needed fascination fee to stymie inflation to no a lot more than 4%, which is a manageable figure for the financial state, with capability boosts ideally permitting it to come down once again to 2-3%.

Whilst the confined improves in rates are one thing we are hopeful about, we nevertheless recognise that it is all pretty unsure, primarily with geopolitics taking part in a job. However, the shares we are seeking at are priced as if the housing market place is searching at certain catastrophe. The housing shortage already implies that there is pent-up demand, building it a much better point of the US economy, but with the return of mobility, we could be in an even superior area in which extreme concerns about desire premiums could possibly not be required any longer, certainly rendering all these stocks’ late-cycle multiples unwarranted. Nonetheless, these quality picks have a ton likely for them no matter.

Tronox (TROX)

The initial inventory to take into consideration is Tronox. They are a vertically built-in producer of titanium oxide, which is used to give paints and coatings their luster. The vertical integration is what you ought to concentration on, since titanium is 1 of quite a few sources that are found in large section in Russia, and could develop into dangerously scarce. Tronox owns their possess titanium and zircon mines which account for 85% of the company’s applied feedstock. This is resilience in each the price composition and business continuity that they can provide. For asset-heavy businesses, acquiring the most affordable cost belongings is an great aggressive advantage, and obtaining their have titanium mines, which is a critical input for aerospace which includes navy aerospace, is critical.

Whilst TROX is not solely dependent on serious estate building, portray and coatings are important products and solutions utilised in the development field, in addition to automotive. With price tag cost savings coming in at extra than 20% in the

coming many years, the existing 4.9x EV/EBITDA multiple could shrink on present earnings to about 3.9x. The margin of protection below is substantial on the lower valuation, and a preset cost framework puts them way in advance of any competition.

Westlake (WLK)

A further extremely interesting organization is Westlake. They are pretty explicitly associated in the manufacturing of merchandise and materials that are more frequently utilized later in the building cycle, in fact exactly where shortages currently are. WLK is a chemicals business that makes polyethylene, styrene, vinyls and PVC as effectively as sells to conclusion-marketplaces finished products and solutions like windows, fittings and piping, where by they capture the total chain of benefit by bringing it to the ultimate purchaser. Quite a few of these goods come from low-cost NGLs that are whole commodities from shale oil procedures, merchandise that are from time to time even burnt or flared off rather than piped over. The margins are strong for this company, where by it is of program even now cyclical, but fewer so due to the fact they are closer to remaining buyers.

When shortages of garage doors and other finishings for residences are what is maintaining inventory unfinished and out of the fingers of the current market, it suggests that the desire for products like Westlake’s involved in getting a house ready to be introduced to the regular consumer is also going through pent-up demand from customers. With the shortage of housing constituting a extended-phrase prospect for desire for WLK’s products and solutions, the enterprise appears incredibly beautiful at valuations of 7x for PE and 4.6x for EV/EBITDA. Again, sizeable margins of security and a good price proposition if you feel that we are however in an upcycle for setting up product volumes, wherever the housing scarcity constitutes a supercycle for these solutions.

West Fraser Timber (WFG) and Interfor (OTCPK:IFSPF)

Westlake and Tronox are a very little considerably less commodified many thanks to their remaining-client dealing with corporations and the useful mines respectively. Interfor and WFG are substantially far more commodified as sellers of lumber, and in the circumstance of WFG also OSB.

Lumber is in a bit of a different location than other constructing merchandise, even nevertheless we nonetheless imagine there is certainly a scenario for it obtaining pent-up demand from customers. The problem with lumber is that the aspect of the constructing cycle where lumber is most crucial has passed, indeed, ideal when you stopped listening to about all individuals lumber shortages. Lumber isn’t in a scarcity correct now, and that is properly reflected in its selling price which has appear down meaningfully from peaks.

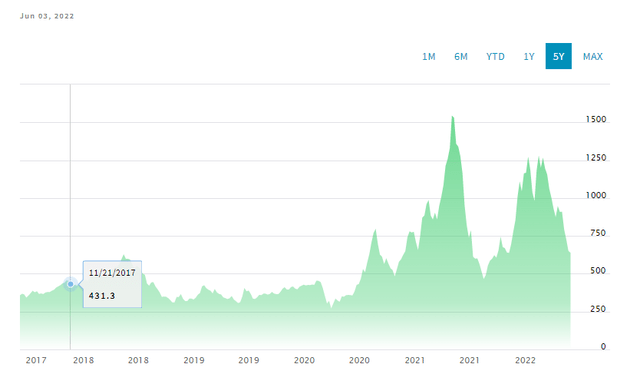

Lumber Charges (Nasdaq)

In truth, mills have had to slow down since the real concern is in having flatbed vans to offtake the lumber. The shortage is no lengthier in mills or forests. In which does this go away companies like Interfor, which generates pretty significantly only lumber? Nicely, we think that if there is a housing shortage, and the current stock is stuck at closing stages in advance of completion, it truly is only a issue of time in advance of that gets settled and lumber is needed all over again. In actuality, growing rates could truly enable this occur quicker as goods trade declines and will make more flatbeds available. As a result, there is attainable pent-up demand from customers for lumber. WFG also provides lumber, as perfectly as OSB which is a minimal a lot more processed and has been getting share absent from common plywood, constituting an extra secular pattern in favour of that product in certain.

Interfor trades at 3x EBITDA, and WFG essentially trades at the exact value, which is in all probability why we’d desire it. Considering the fact that WFG also has OSB marketplaces, that will make them slightly significantly less commodified. They deserve a quality for that which they will not presently have, which indicates a 20% relative undervaluation. Nevertheless, each Interfor and WFG are low-priced in our view as when the developing cycle restarts, that will be equipped to sustain lumber prices and volumes at minimum at the latest levels for a different pair of a long time. With the payback time period on these investments becoming particularly that, only a few of years given the multiples, we’re quite delighted with the valuation, the place any much better than envisioned final result renders their valuations quite flawed.

Bottom Line

Housing may possibly be a bright place in the US overall economy, even if rates increase. In actuality, creating product or service volumes, in particular, could even reward from to begin with climbing prices as it would totally free up logistics to support the making cycle go more quickly as described higher than.

Nevertheless, there are crystal clear dangers. Numerous are ideal to be fearful about the financial system. Shortening credit score is a terrifying prospect for the overall economy, and at some point, substantial plenty of charges could cause a deleveraging. If the capability to repay the massive volume of debt accumulated by privates in these final yrs of minimal costs, the housing marketplace will just take a massive hit, and builders will undoubtedly end pushing to establish houses.

So there is a sweet location of fascination rate hikes that will potentially assist, or at the very least not harm, these shares. Not shifting past that sweet spot will be helped by the return of the encounter financial state as well, which must take strain off the products trade. But for the reason that you’re taking part in that match, these stocks should really all be regarded speculative. They usually are not far from all-time highs, and the sector is pricing them as if they’re at the stop of their cycles. If the economic system is doomed to put up with a economic downturn, then these multiples are possibly quite appropriate. But even with economic downturn risk, the multiples are lower sufficient in which each calendar year of benefiting from the housing scarcity meaningfully raises the protection of the investment at current costs.